Ever wondered how a small mold problem can snowball into a health crisis that costs you thousands in medical bills? Yeah, me too—until my cousin’s “tiny” basement leak turned into a $20k nightmare of hospital visits and home repairs. Let’s talk about Long-Term Health Monitoring and why your mold insurance might just be the unsung hero protecting both your lungs and your wallet.

What You’re About to Discover

- Why mold is sneakier than you think—and how it ties to long-term health monitoring.

- A step-by-step guide for evaluating mold risks (and what to do next).

- Best practices for selecting the right mold insurance policy.

- Real-life case studies where people avoided financial ruin with smart planning.

Key Takeaways

- Mold isn’t just ugly—it’s dangerous. Long-Term Health Monitoring helps catch symptoms early.

- Your credit card points aren’t enough to cover mold-related disasters; proper insurance is key.

- Mold remediation costs skyrocket without intervention. Prevention pays off big time.

Section 1: The Hidden Dangers of Mold on Long-Term Health

“Optimist You: ‘It’s just a little dampness—it’ll dry out!'”

Grumpy Me: ‘Yeah, sure… until black mold shows up like an uninvited party guest.'”*

Mold exposure is no joke. According to the CDC, prolonged exposure can lead to respiratory issues, skin irritation, fatigue, and even neurological problems in extreme cases. And if you live in humid climates or older homes, mold spores love hanging around like freeloaders at a buffet. This is where long-term health monitoring becomes crucial—you need to track symptoms over months or years to connect them back to environmental factors like mold.

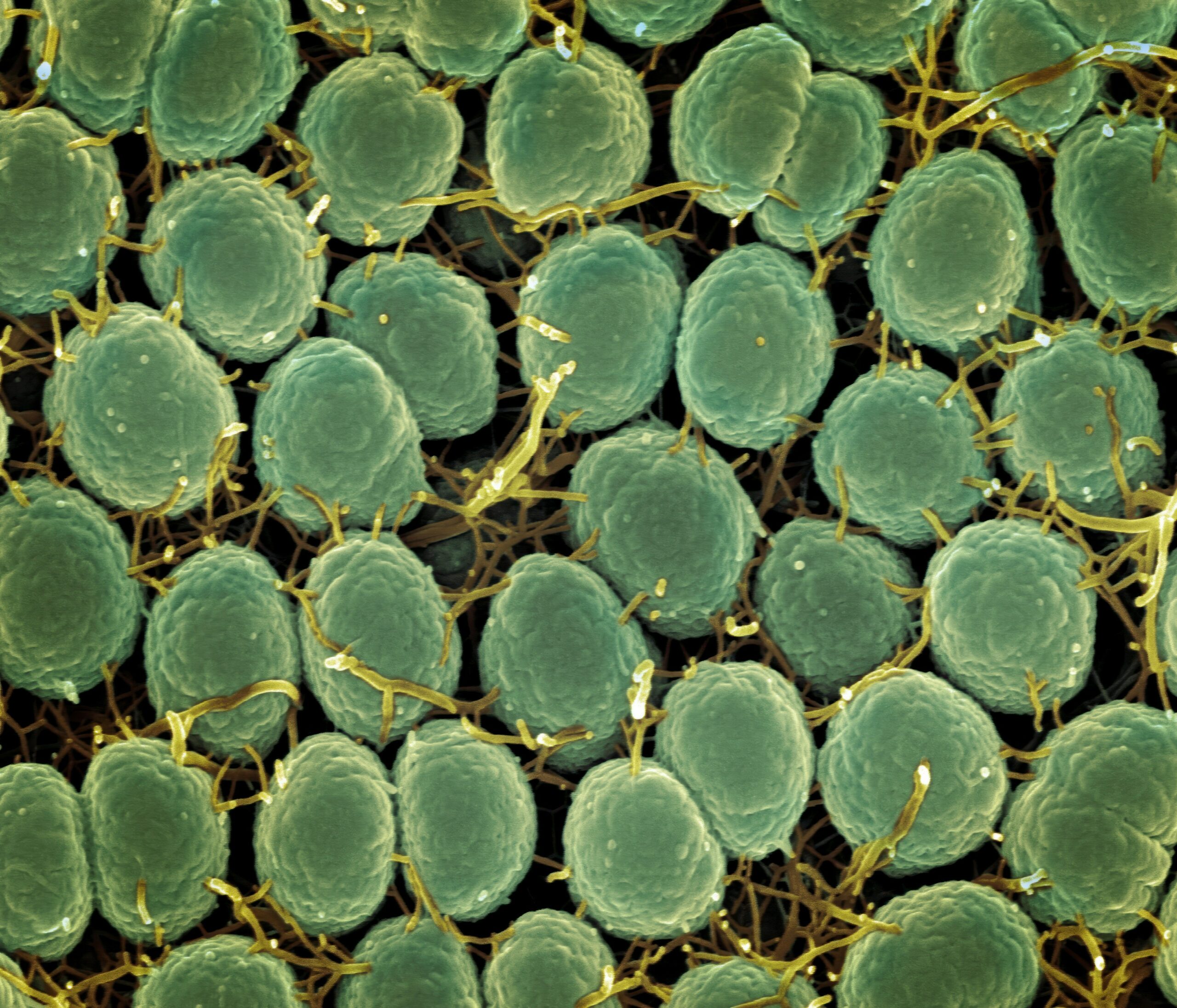

Image: How mold affects human health—focus on respiratory pathways.

Rant Alert:

One pet peeve? People who ignore musty smells because they “don’t have time” to investigate. Look, I get it—life gets busy. But ignoring mold doesn’t make it go away. It makes it worse. So grab a flashlight, stop scrolling TikTok for five minutes, and check those corners.

Section 2: Step-by-Step Guide to Mold Risk Management

- Assess Your Environment: Walk through every room looking for leaks, discoloration, or weird odors.

- Test the Air Quality: DIY kits are cheap (~$25), but professional testing provides deeper insights.

- Talk to Your Doctor: If family members start coughing, sneezing, or feel unusually tired, bring up mold as a possible cause.

- Evaluate Your Insurance Coverage: Does your current plan include mold damage or remediation? If not, upgrade ASAP.

Image: Affordable DIY mold testing kits are a great first step.

Section 3: Tips for Choosing the Best Mold Insurance

- Ask About Caps: Many policies cap mold damage payouts at $10k–$20k. Make sure it’s sufficient for your area.

- Look for Added Benefits: Some insurers offer discounts for installing dehumidifiers or using mold-resistant paint.

- Read Reviews: Google reviews matter here! Real customer experiences reveal hidden fees or claim hurdles.

Pro Tip: Don’t skimp on premiums. Cheap plans often exclude common scenarios like plumbing leaks leading to mold growth. Spend a bit more now to save a ton later.

Section 4: Case Studies That Prove Mold Insurance Works

Case Study #1: Sarah Avoided Disaster

Sarah from Seattle noticed a small water stain near her kitchen sink but shrugged it off. Six months later, she developed chronic headaches. After consulting a doctor, she discovered her home had toxic mold levels. Thanks to her comprehensive insurance policy, her $30k cleanup was fully covered.

Case Study #2: Mike Saved Himself Stress

Mike, living in Florida, knew his region’s humidity made mold inevitable. He invested in robust insurance and scheduled annual inspections. When inspectors found minor mold behind his bathroom tiles, quick action prevented major structural damage.

Image: Professional house inspection catching early mold signs.

Section 5: FAQs About Long-Term Health Monitoring and Mold Insurance

Q: Do all insurance policies cover mold?

Absolutely not. Standard homeowners’ policies typically exclude mold unless it results from a covered peril like a burst pipe.

Q: How much does mold remediation cost?

Average costs range from $1,000 to $6,000, depending on severity. Severe infestations can hit $30k+.

Q: Can air purifiers help reduce mold risks?

They can trap some airborne spores, but addressing the root source (moisture) is essential.

Conclusion

Mold may seem like a distant worry, but trust me—it creeps up faster than you’d expect. By combining Long-Term Health Monitoring with solid mold insurance, you protect yourself financially and physically. Keep tabs on your health, inspect your home regularly, and invest wisely in coverage. And hey, maybe throw in a dehumidifier while you’re at it. Future You will thank Present You.

Like duct tape, good mold insurance fixes everything. Or almost. 🤷♀️